Get the free premium receipt

Show details

Date: 13Dec2017 Receipt No.: 139684310 DEC201701Life Insurance Premium Receipt Duration For Which the Premium is Received: 12DEC2017 to 11JAN2018 Personal Details Policy Number:139684310Current residential

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign insurance premium receipt form

Edit your insurance receipt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 80d medical insurance premium receipt pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing health insurance sample pdf online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit premium receipt insurance form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out insurance payment receipt form

How to fill out 80d medical insurance premium:

01

Gather all necessary documents such as ID proof, address proof, medical bills, and receipts.

02

Ensure you have the correct form for filing the 80d medical insurance premium.

03

Fill in personal details such as name, address, contact information, and PAN number.

04

Provide details about the medical insurance policy, including the name of the insurer, policy number, and premium amount.

05

Enter the total medical expenses incurred during the financial year for which the premium is being claimed.

06

Attach supporting documents such as medical bills, prescriptions, and receipts to substantiate the claimed expenses.

07

Double-check all the information provided and make sure it is accurate and complete.

08

Sign the form and submit it along with the supporting documents to the designated authority.

09

Keep a copy of the filled form and supporting documents for future reference.

Who needs 80d medical insurance premium:

01

Individuals who have purchased a medical insurance policy for themselves or their family members.

02

Those who have incurred medical expenses during the financial year and wish to claim deductions under section 80d of the Income Tax Act.

03

People who want to avail tax benefits on the premium paid towards their medical insurance policy.

Fill

life insurance receipt

: Try Risk Free

People Also Ask about life insurance bill

How do I get an 80D certificate?

Other Important terms & conditions in Section 80DD The certificate can be obtained from a specialist doctor as per the cases applicable. Certificate from government hospital is not mandatory, and it can be obtained from a private hospital.

How do I get 80D?

As per section 80D, a taxpayer can deduct tax on premiums paid towards medical insurance for self, spouse, parents, and dependent children. Individuals and HUF can claim this deduction. The limit of the deduction varies with age. A deduction of Rs 25,000 is available for self, spouse, and dependent children.

Where to fill schedule 80D?

For claiming tax benefit filing of ITR is mandatory. At the time of filing ITR you need to disclose 80D deduction under “Deduction under chapter VI-A”.

What is the rebate under Section 80D?

Section 80D allows an individual to claim tax benefit for preventive health check-up of Rs 5,000. This tax-benefit is available within the maximum deduction limit of Rs 25,000 or Rs 50,000, as the case maybe.

Is health insurance paid by my employer taxable income?

Health Plans If an employer pays the cost of an accident or health insurance plan for his/her employees (including an employee's spouse and dependents), then the employer's payments are not wages and are not subject to social security, Medicare, and FUTA taxes, or federal income tax withholding.

What is the taxability of medical insurance paid by employer in India?

The taxability of medical insurance paid by the employer will also be 50% of the total premium amount.

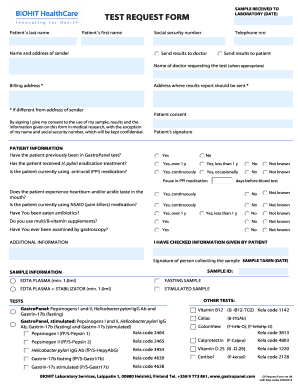

What is a premium receipt in insurance?

PREMIUM RECEIPT Definition & Legal Meaning A receipt given out to a policy holder, by the insurer or an agent on behalf of the insurer, which provides confirmation that payment has been received.

What is the importance of first premium receipt?

After receiving the payment, the insurance company issues the First Premium Receipt. The first receipt acknowledges that the proposal of the life insurance is assured. It contains all details of the policy, including the Tax/Premium Paid Certificate.

What is the deduction for insurance premiums?

An individual can claim a maximum deduction of Rs 25,000 for insurance premiums for self, spouse and dependent children. Individuals can claim a maximum deduction of up to Rs 50,000 if paying a premium for (i) self, spouse, dependent children, and (ii) parents below 60 years of age.

What is the deduction for 80dd?

The deduction limit permitted u/s 80 DD is up to Rs. 75,000 in cases of disability up to 40%. The annual limit for availing deductions u/s 80 DD is Rs. 1.25 Lakhs per annum for taking care of a disabled person with disability up to 80% or more.

Can I claim both 80C and 80D?

80D is a tax deduction available to individuals and HUFs for medical insurance premiums paid for self, spouse, children, and dependent parents. This deduction is available in addition to the 80C deduction.

Which is a premium receipt?

A 'Renewal Premium Receipt' shows the amount of premium that you have paid for your policy. It can be submitted as an investment proof to the taxation authority for receiving tax~ benefits.

Can I claim medical insurance premiums on my taxes?

Health insurance premiums are deductible if you itemize your tax return. Whether you can deduct health insurance premiums from your tax return also depends on when and how you pay your premiums: If you pay for health insurance before taxes are taken out of your check, you can't deduct your health insurance premiums.

What do you fill in 80D?

Individual and Hindu Undivided Family (HUF) can claim deduction from taxable income under Section 80D. A person can claim a deduction for the health insurance premium and expense incurred towards preventive health checkup for self, spouse, dependent children and parents.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit insurance receipt template from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your payment insurance receipt into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I create an electronic signature for the insurance slip in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your health insurance receipt in seconds.

How do I complete policy receipt on an Android device?

Use the pdfFiller mobile app and complete your medical insurance receipt and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is 80d medical insurance premium?

80D medical insurance premium refers to the section of the Income Tax Act in India that allows taxpayers to claim deductions on premiums paid for health insurance policies for themselves, their spouses, dependent children, and parents.

Who is required to file 80d medical insurance premium?

Taxpayers in India who have paid premiums for health insurance policies and wish to claim deductions under Section 80D of the Income Tax Act are required to file this information when filing their income tax returns.

How to fill out 80d medical insurance premium?

To fill out 80D medical insurance premium, taxpayers should report the total amount of premiums paid in the relevant section of the income tax return form. This includes details of premiums paid for self, family, and parents.

What is the purpose of 80d medical insurance premium?

The purpose of 80D medical insurance premium is to encourage individuals to take health insurance policies by providing them with tax benefits on the premiums paid, thereby promoting financial security against health-related expenses.

What information must be reported on 80d medical insurance premium?

Taxpayers must report the total premium amount paid for health insurance, the name(s) of the insured persons, the policy number, and the duration of the insurance coverage for which the premium was paid.

Fill out your premium receipt form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Health Insurance Premium Receipt is not the form you're looking for?Search for another form here.

Keywords relevant to premium receipts

Related to health insurance invoice

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.